Transfer Pricing & International Taxation

Discover seamless and compliant global financial solutions with WBN Consulting’s expert Transfer Pricing and International Taxation services. Ensure fair profit allocation and navigate complex tax laws across borders for your business success. Trust our guidance for smooth international transactions.

What is Transfer Pricing?

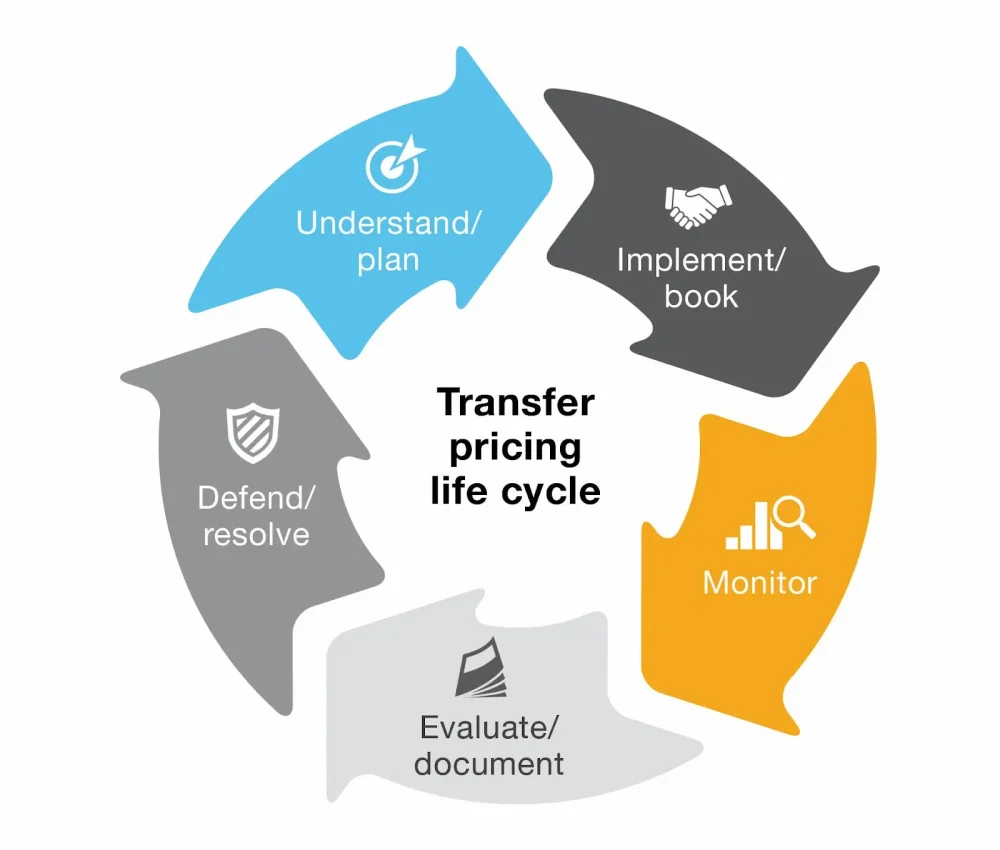

Transfer Pricing (TP) is an accounting practice established to address the complex concerns arising from transactions between connected entities within a global corporation, especially with increased involvement of international corporations in India’s economic activity.

In 2001, the Indian Income Tax Act was amended to include transfer pricing regulations. The primary objective of TP is to ensure appropriate allocation of profits among different subsidiaries or divisions of a company across different countries, taking into consideration local tax laws and regulations.

These regulations in India adhere to OECD norms and encompass various transfer pricing mechanisms and documentation processes. Failure to comply with TP regulations may result in significant penalties.

Significance of TP

Transfer pricing is an essential accounting practice aimed at ensuring the fair allocation of profits among different subsidiaries or divisions of a multinational company operating in multiple countries. The goal is to strike a balance that aligns with local tax laws and regulations.

India’s transfer pricing regulations adhere to the norms set forth by the Organization for Economic Co-operation and Development (OECD). These comprehensive regulations encompass various transfer pricing mechanisms and stringent documentation processes, aimed at ensuring transparency and compliance.

Non-compliance with transfer pricing regulations can lead to significant penalties, underscoring the critical importance of adherence to these norms for international corporations conducting business activities in India.

Services WBN Offer

- Pre-assessments and real-time planning

- Strategic guidance for setting up/restructuring complex cross-border transactions

- Preparation of TP documentation for penalty protection, including TP Study, Benchmarking analysis, Master file, and Country by Country Report

- Drafting inter-company agreements

- Guidance on primary and secondary adjustments

- Optimization of TP margins

- Advising on negotiation and implementation of Advance Pricing Agreements (APAs) with tax authorities

- TP-related due diligence reports

- Representation of clients in dispute resolution stages and forums

- Conducting TP audits and issuance of accountant’s report (Form 3CEB)

- Assisting in the application of safe harbor provisions (Form 3CEFA and Form 3CEFB)

Tax Deducted at Source (TDS) is a tax collection mechanism where the payer deducts tax at the time of making payment to a non-resident or foreign company. Under the Income Tax Act, 1961, individuals making payments to non-residents may be required to deduct TDS. It is crucial to deposit TDS on outward remittances with the government within the specified time frame to avoid interest and penalties.

Services WBN Offer

- Guidance on TDS applicability, considering Double Taxation Avoidance Agreements (DTAA) and relevant laws

- Assisting with TDS compliances, including filing returns and issuing certificates

- Handling compliances related to forms like 15CA, Form 15CB, Form 15CC, Form 10F, etc.

- Auditing TDS compliances

Equalization Levy (EL)

The Equalization Levy (EL) is a tax imposed by the Indian government on specified transactions involving non-resident e-commerce operators and non-resident service providers offering services related to online advertisements and digital advertising space. It was introduced in India in 2016 to ensure that non-resident service providers and e-commerce operators contribute to Indian tax revenue.

Services WBN Offer

- Assistance with computation and compliance procedures related to EL

- Advisory and consulting services for transaction taxes

- Representation in dispute resolution related to EL

Taxation of Expatriates

An expatriate is a person temporarily residing and employed in a foreign country while remaining a citizen of their native land. The taxation of expat employees requires a slightly different computation than that of normal resident employees of an Indian organization.

Services WBN Offer

- Tax planning for expatriates

- Ensuring tax compliances for expatriates

- Obtaining a Certificate of Coverage and Income Tax Clearance Certificate

- Calculating tax equalization for expatriates

- Assisting in claiming foreign tax credit (FTC)

- Assessing tax residency status

- Representing expatriates in assessments, appeals, opinions, and litigation matters

Tax Residency Certificate (TRC)

A Tax Residency Certificate (TRC) is a document issued by a country’s tax authority to confirm an individual’s or entity’s tax residency status. It is often required to claim tax benefits under a tax treaty between two countries, preventing double taxation and ensuring transparency in remittance.

Services WBN Offer

- Assisting with the application and acquisition of a TRC for residents in India (Form 10FA and 10FB)

- Providing guidance on navigating complex tax laws and regulations of different countries

- Assisting in preparing and submitting essential documents for obtaining a TRC

TDS on Properties of NRIs

When a resident buys property from a Non-Resident Indian (NRI), they must deduct TDS at different rates depending on the holding period of the property.

Services WBN Offer

- Ensuring compliance with Indian tax laws and fulfilling TDS requirements

- Assisting in applying for a PAN (Permanent Account Number)

- Obtaining a lower tax deduction certificate (Form 13)

- Computation of capital gains

- Advising on tax exemptions related to capital gains

- Assisting with repatriation of proceeds (Form 15CA and Form 15CB)

- Providing guidance on claiming foreign tax credit (FTC).

Transfer Pricing refers to the accounting practice of allocating profits appropriately between different subsidiaries or divisions of a company operating in different countries. It ensures compliance with local tax laws and regulations while preventing profit shifting. For international corporations, it is crucial to establish arm’s length prices for transactions between connected entities to avoid tax-related issues and penalties.

Yes, WBN Consulting provides guidance and aid in acquiring Tax Residency Certificates (TRCs) for residents in India. They help clients navigate the complex tax laws and regulations of different countries and assist in preparing and submitting the necessary documents to obtain TRCs.

WBN Consulting offers concrete guidance on the applicability of Tax Deducted at Source (TDS) considering Double Taxation Avoidance Agreements (DTAA) and relevant laws. They assist clients with TDS compliances, including filing returns, issuing certificates, and handling various forms such as 15CA, Form 15CB, Form 15CC, Form 10F, etc. Additionally, they provide auditing services to ensure TDS compliances are met.